How to stake IUM

Earn rewards while protecting IUM

Any user with any amount of IUM can help protect network security and earn rewards in the process.

Total nodes

Total IUM pledged

Clients

Annualized

%

Traditional staking refers to depositing 200,000 IUM to activate the node's software. As a node, you are responsible for storing data, processing transactions, and adding new blocks to the blockchain. This ensures the security of IUM for everyone and earns you new IUM in the process. Our public chain, however, does not use a beacon-like staking system. Instead, it uses contract-based staking. There is no beacon client; only a modified geth deployment. Staking is completed through the contract, and it is divided into node staking and Client staking (Clients do not need to deploy geth).

Earn rewards

Actions that help the network reach consensus are rewarded. You'll be rewarded for running software that correctly packages transactions into new blocks and checks the work of other validators, as these actions keep the blockchain running securely.

More secure

As more and more IUM is staked, the network becomes increasingly powerful because a huge amount of IUM is needed to control most of it. To attack the network, you need to control most of the validators, which means you need to control a large portion of the IUM in the system – that's just too much!

More sustainable

Stakers can participate in the security network without performing energy-intensive proof-of-work calculations, meaning that staking nodes can run on relatively simple hardware and consume very little energy.

More IUM energy informationIt all depends on how much you want to stake. You'll need at least 200,000 IUM to activate your own node, but you can also choose to stake less IUM. Review the options below and choose the one that best suits you and your network.

Node side

Becoming a node (staking 200,000 tokens or a multiple of 200,000) is the standard for IUM nodes. It provides full participation rewards, improves the decentralization of the network, and eliminates the need to entrust your funds to anyone else.

Users considering becoming node operators should hold some IUM and have a dedicated computer with 24/7 internet access. Some technical knowledge is helpful, but existing, user-friendly tools can streamline the process.

Node stakers can pool funds from other stakers to stake together, or stake at least 200,000 IUM individually. Liquidity staking token solutions can be used to maintain access to decentralized finance (DeFi).

Clients

If you don't want to or are unfamiliar with dealing with hardware, but still want to stake your IUM, the Staking as a Service plan will allow you to delegate the hardware you use when earning native block rewards.

These options typically involve creating a set of validator certificates, uploading your signing key to them, and staking 10 (or multiples of 10) IUM. This will allow the service to perform validations on your behalf.

This staking method requires a certain level of trust in the provider. To limit the risk to the other party, the key to extract your IUM is usually kept in your possession.

No single solution applies to all staking scenarios; each is unique. Here, we compare the risks, rewards, and requirements associated with different staking methods.

Node side

Pledge threshold

Starting from 200,000

(Staking 200,000 tokens to become a node or a multiple of 200,000 tokens)

(Staking 200,000 tokens to become a node or a multiple of 200,000 tokens)

Function

Submit commit/reveal

Clients

Pledge threshold

10 Power

(Stake 10 to become a Client or a multiple of 10)

(Stake 10 to become a Client or a multiple of 10)

Function

Dividends based on node

14%

Distribute to nodes according to the Client's staking weight.

Distribute to nodes according to the Client's staking weight.

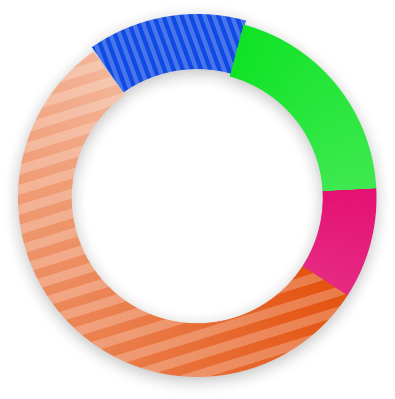

Sources and distribution ratios of transaction fees

The fees generated from each block are distributed as follows:

Proposer (block proposer)

Incentives for block production and chain stability

All Delegators

Allocation based on pledge weight

Indicated by public announcement:

The principal's pledged shares (D value)

Each client must choose a tier, which affects the reward weight. Tiers 1-8 correspond to the following 'weighted days':

Gear (day) Day weighting

1 30 days

2 60 days

3 90 days

4 120 days

5 150 days

6 180 days

7 210 days

8 240 days

Note: This is not the lock-up period, but the reward weight period (the unlocking time can be designed to correspond to the level).

Principal Weight Formula

Each clientThe weight is defined as:

In:

Pledged Amount

Gears (1-8)

Using a horizontally placed root can:

Reduce the advantage of whales and avoid excessive concentration of power.

Encourage smaller nodes to participate.

Client reward percentage

The client receives 70% of the commission:

InThe total weight of the client.

Final reward calculation formula

Expanded, it can be written as: